The AI Tax Research Solution Outlook Report is Here

Together, Blue J and CPA.com surveyed 150+ tax practitioners, to bring you real-world data on how your peers are approaching tax research. Read the results below or download the PDF for a copy that’s yours to keep.

Executive Summary

We stand now at a pivotal moment for the tax profession. Already, AI is causing a fundamental shift in the way accounting firms and tax practitioners work. Nowhere is this more evident than in the area of tax research, where recent advances in generative AI are redefining what the modern tax tech stack looks like. With the momentum of generative AI and the complexity of the tax environment both increasing, Blue J and CPA.com sought to understand how AI is being used in accounting firms and how this technology is impacting firm performance.

Through a joint survey conducted by Blue J and CPA.com, we gathered input from over 150 tax practitioners, focusing on their outlook for AI-powered tax research solutions. Leveraging this survey data and user data from Blue J’s own generative AI solution for tax research, we’ve found that AI is rapidly transforming day-to-day workflows—delivering measurable advantages over legacy solutions.

Key Findings from the AI Tax Research Solution Outlook Report

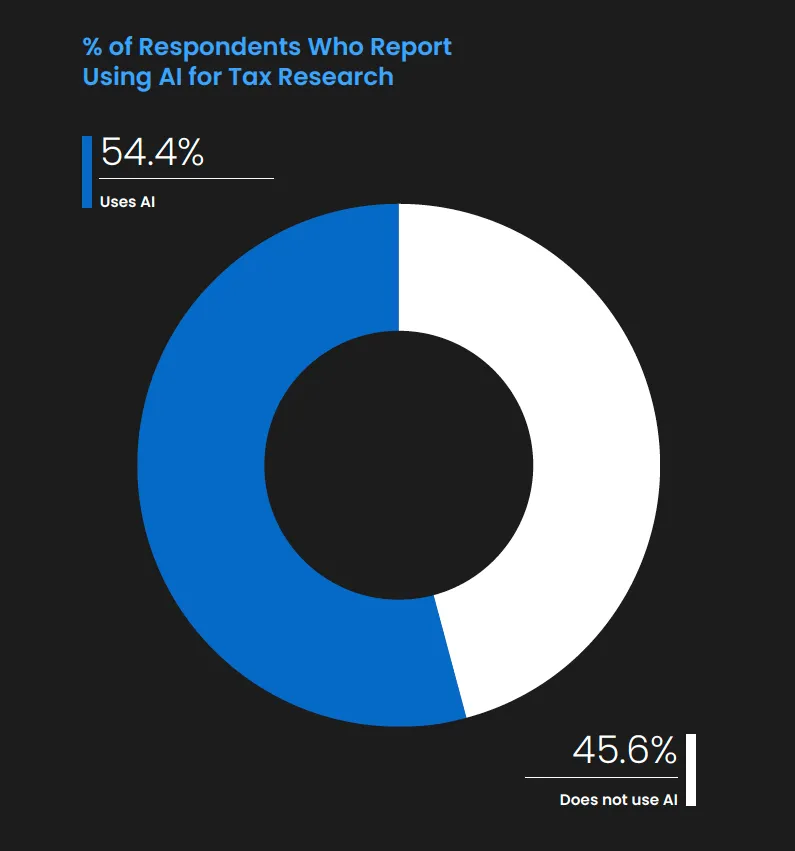

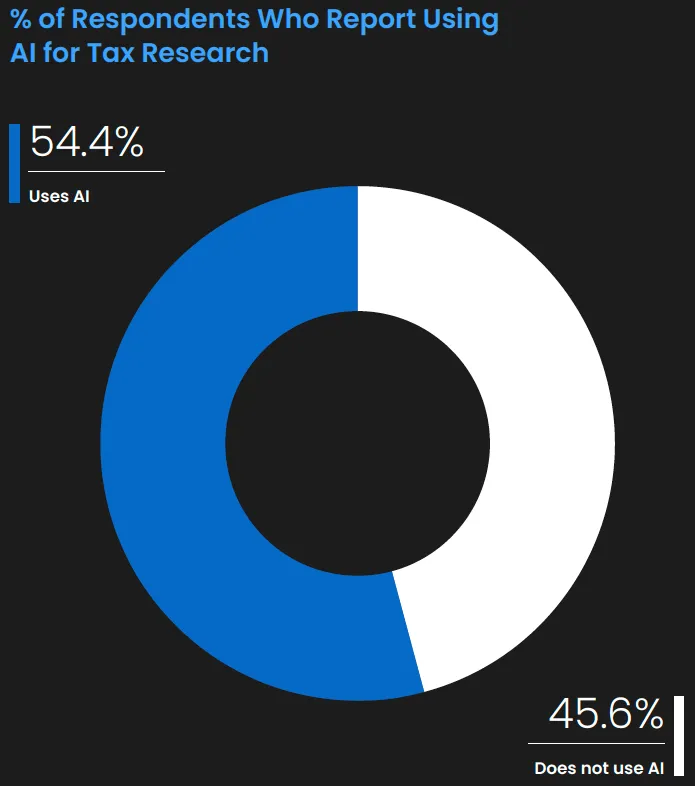

- AI adoption is on the rise across accounting workflows, especially for tax research, with 54.4% of respondents already using it to complete research in some form.

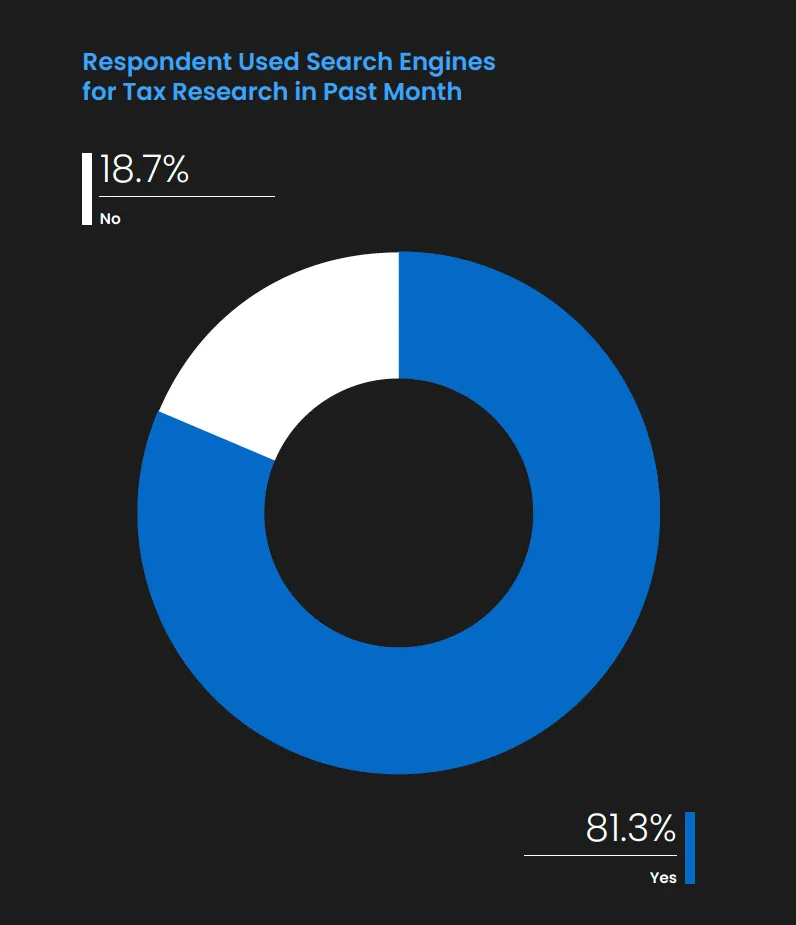

- On average, respondents have access to three tax research tools; however, adoption of these tools remains low, with 81.3% of respondents turning to search engines for tax research, despite paying for a suite of tools.

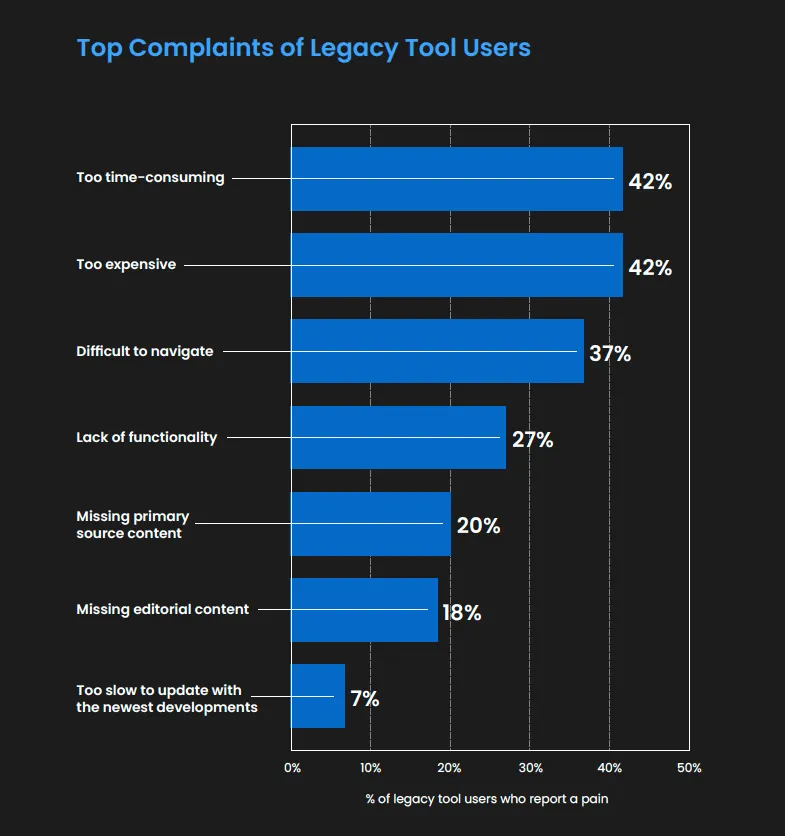

- Poor adoption of tax research tools is largely driven by poor user experience, with 42% of respondents saying legacy tax research tools are too time-consuming to use.

- AI-powered tax research tools can solve these experience issues, helping tax practitioners arrive at better tax answers, faster. Respondents note that it saves them 2.94 hours/week across both research and drafting work.

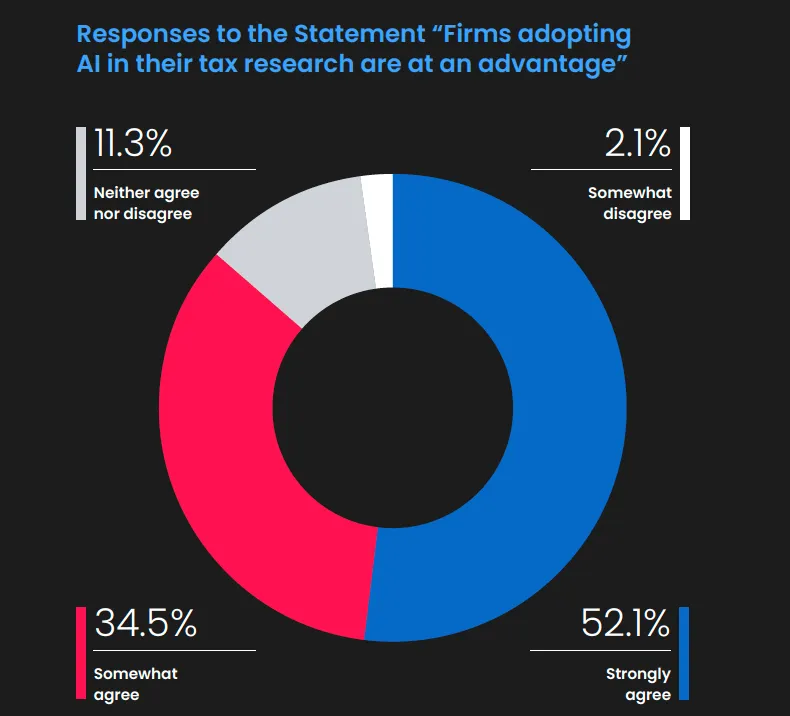

- Accelerated research is one of several factors contributing to the clear competitive advantage AI generates for firms, with 86% of respondents agreeing that AI-powered tax research generates an advantage for firms.

If there’s one common theme we uncovered through our research, it’s that AI-powered tax research is only going to continue building momentum. Which leaves firms with a choice: incorporate now or risk falling behind.

Methodology

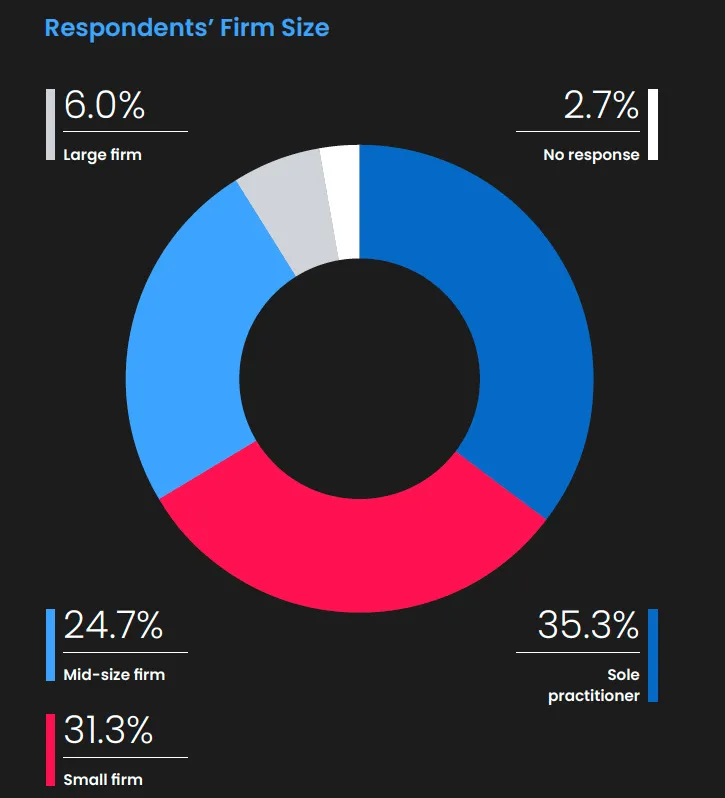

This outlook report was made possible by the tax and accounting professionals who participated in our outlook survey. Together, Blue J and CPA.com collected responses from over 150 tax practitioners at tax and accounting firms.

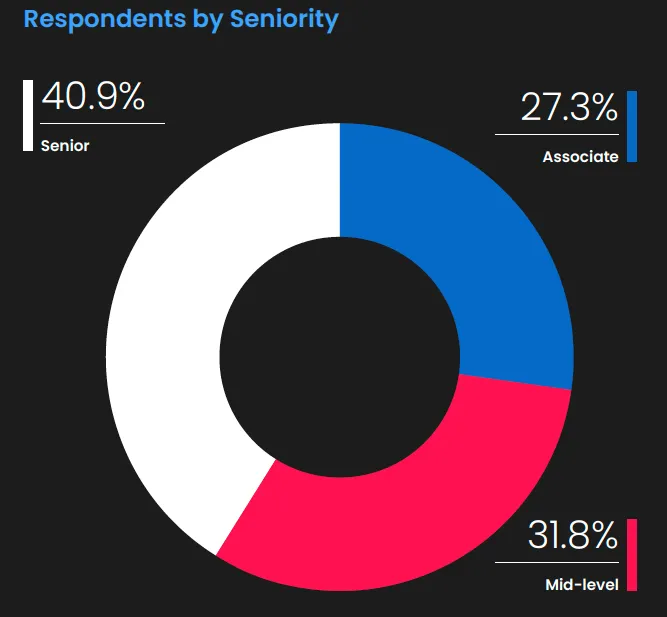

Among respondents who were part of multi-member firms (i.e., not sole practitioners), roles are fairly evenly split across associate, mid-level, and senior experience levels.

To augment this report, we’ve also incorporated user and survey data from Blue J’s customers. Blue J is the leading generative AI solution for tax research, built on a library containing only the most trusted sources in tax and used by accounting firms of all sizes. These Blue J customers have provided us with an invaluable view into how real tax practitioners are using and benefiting from AI today.

We’d like to thank the tax and accounting professionals who responded to our outlook survey—as well as Blue J’s customers—for sharing their insights and helping to create the Blue J and CPA.com AI Tax Research Solution Outlook Report.

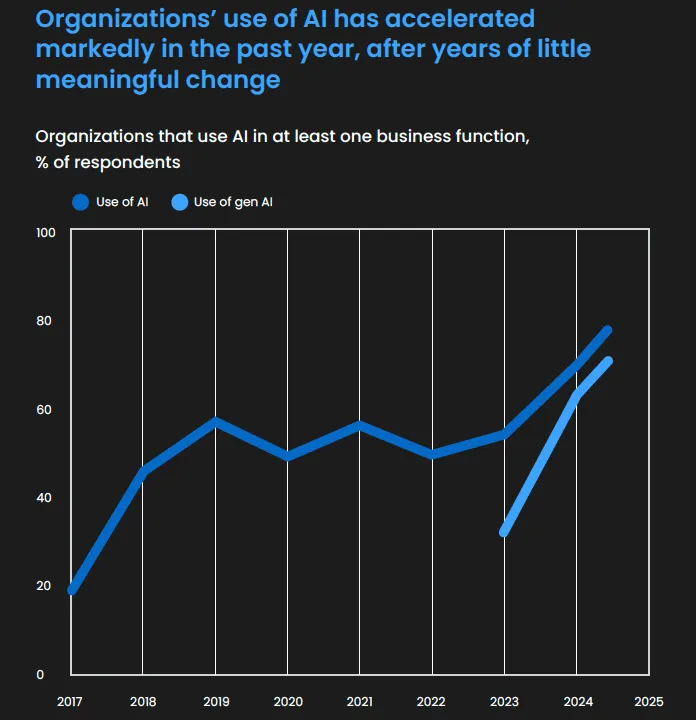

Trends in Overall AI Adoption

This outlook report focuses on AI for tax research, but this application of AI is just one of many within the larger landscape. Recent years have seen an increase in AI usage across fields, with generative AI demonstrating particularly rapid organizational adoption following the launch of OpenAI’s ChatGPT in November 2022.

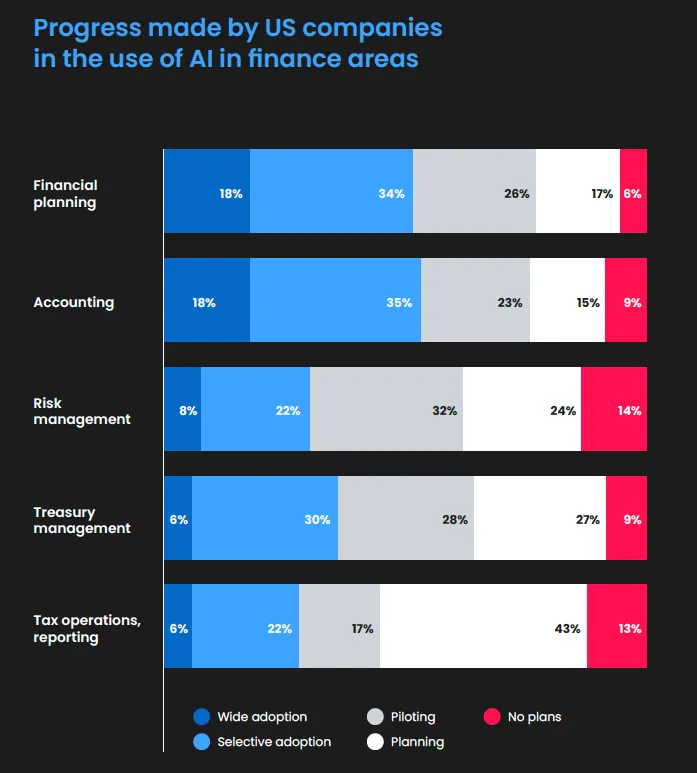

In finance-related areas, accounting is among the most advanced for integrating AI, with 76% of respondents to a recent KPMG survey reporting some degree of AI usage. Conversely, tax operations and reporting is among the least advanced for integrating AI, with only 45% of respondents using AI. The starkest difference between these two applications is at the level of widespread adoption, which sits at 18% for accounting, compared to just 6% for tax operations and reporting.

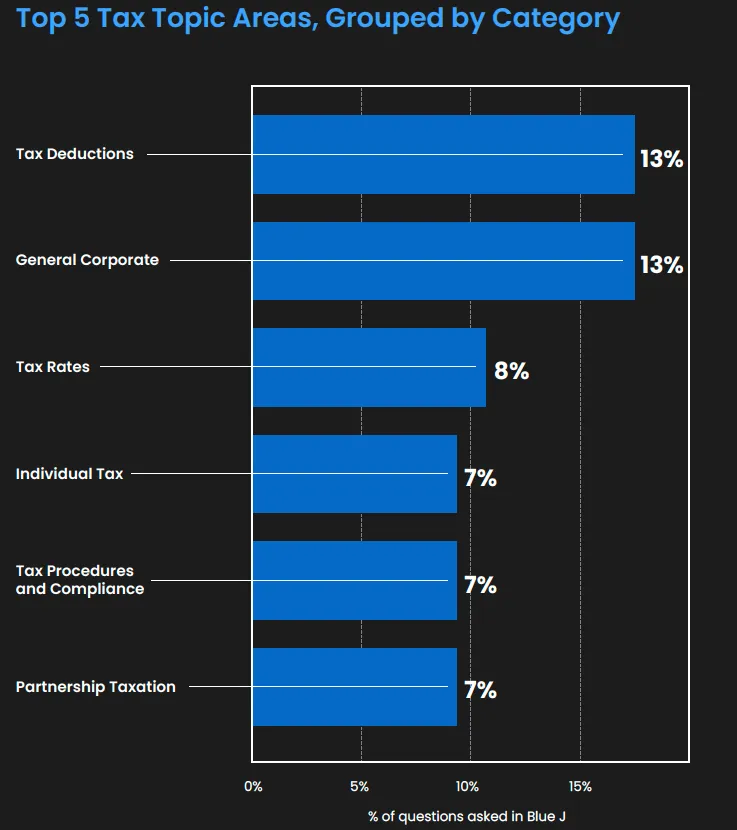

As for the exact use cases in which accounting professionals are currently deploying AI, research is on the rise. At Blue J, we’ve witnessed the rapid rise of generative AI for tax research firsthand. After launching our generative AI solution for tax research in mid-2023, the solution went on to answer 1,000,000 tax questions by March 2025 and reached the 2,000,000 question mark just a few months later, in July 2025.

+735% increase in questions asked YoY between July 2024 and July 2025

(Source: Blue J User Data)

The rise of AI for tax research is, in many ways, unsurprising. Because tax law is complex and rich in text, it’s well-suited to the large language models powering many generative AI applications, in both understanding tax context and generating comprehensive responses. To see this level of adoption and usage for such a relatively new technology is a powerful testament to generative AI’s unprecedented momentum.

The State of Tax Research Solutions

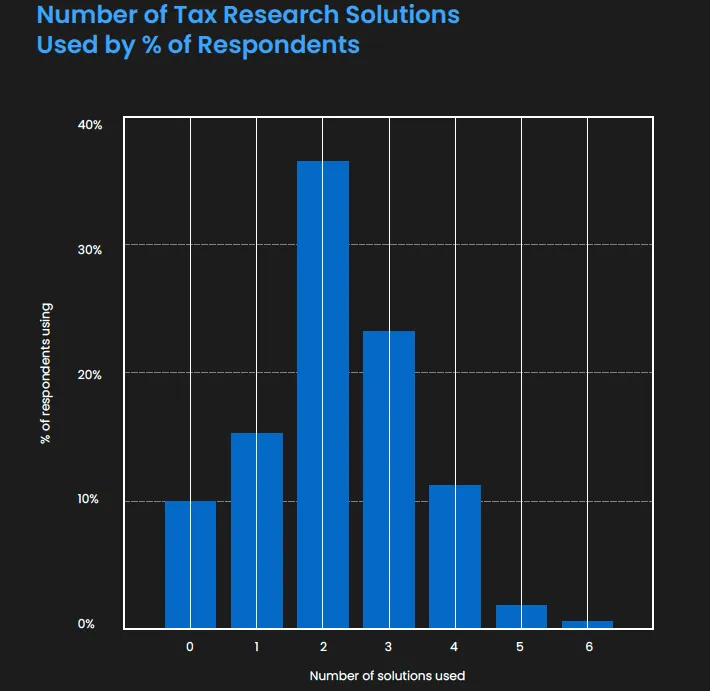

When we examine the current state of tax research solutions within firms, it’s just that: a state of multiple solutions. On average, respondents to our outlook survey have access to three tax research solutions. However, they only report using two of these three solutions on a weekly or daily basis.

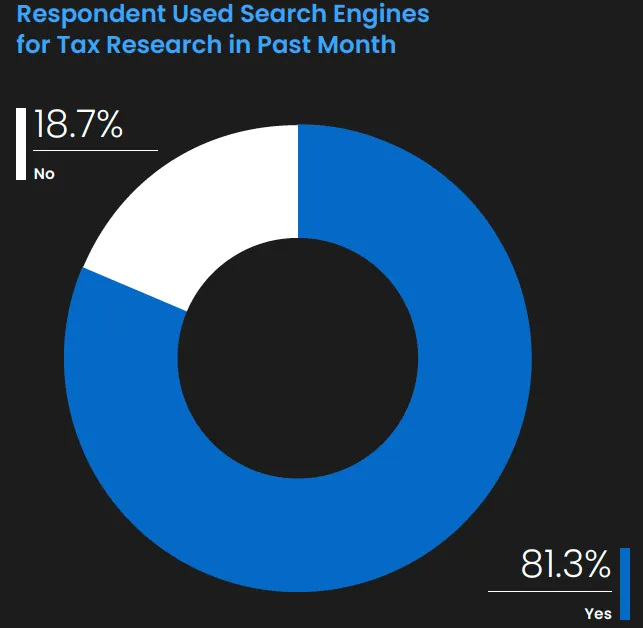

Despite having access to a selection of often costly tax research solutions, the vast majority (81.3%) of respondents also reported regularly using search engines, such as Google, to perform tax research. Due to the issues that can come with using search engines for high-stakes tax research—namely, that the answers rely on uncurated sources that are often outdated and difficult to verify—this data should be concerning, particularly when small mistakes can lead to costly client outcomes.

This data also brings up an important question. Why are firms that are paying for multiple tax research solutions still turning to search engines for their tax questions? To find the answer to this question, we need to turn to a particular class of solutions: legacy tax research tools.

Where Legacy Solutions Are Failing Firms

Of those respondents who report using legacy tools for tax research, very few actually use them. Legacy tools demonstrate consistently lower adoption rates compared to other classes of solutions, with weekly or daily usage rates ranging from 50% to 61%. By comparison, adoption rates for tax-specific AI tools are significantly higher, with 88% of those who have access to AI-powered tax research tools reporting weekly or daily usage.

Aside from the budget wasted on unused legacy tools, there’s another concern: tax practitioners turning to search engines instead. Firms pay for the trusted sources and editorial content these legacy tools offer, but access to that library means little if teams can’t easily find the sources they need. While some legacy tools are incorporating AI add-ons to counteract navigation issues, these often fall short on answer accuracy compared to AI-first tax research tools.

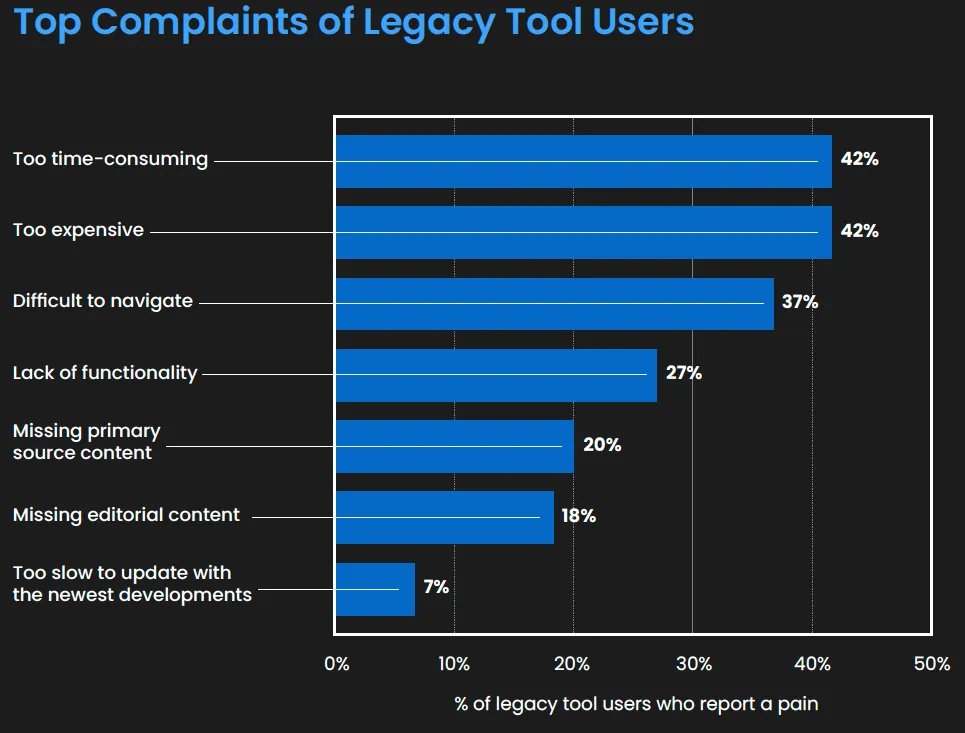

When trying to understand the adoption gap between legacy and AI-powered tax research solutions, respondents’ complaints about legacy solutions shed light on some possible causes.

Those using legacy tools for their tax research have three main complaints: they’re too time-consuming to use (42%), too expensive (42%), and difficult to navigate (37%). Beyond speed, cost, and navigation problems, respondents also complain about a lack of functionality (27%), missing primary content (20%), and missing editorial content (18%). Together, these issues point towards a poor user experience that would naturally discourage regular use.

The AI Tax Research Advantage

Whereas low adoption and slow, cumbersome research are the hallmarks of traditional tax research tools, high adoption and accelerated research are what set AI-powered tax research solutions apart.

Legacy tax research tools typically rely on complex Boolean searches to source the correct documents. From there, tax practitioners must navigate these sources and manually stitch together a cohesive response. The complicated search operators required by each tool also mean that firms often use multiple solutions, with different people in the firm each having their "favorite" tool that they've come to know inside and out. However, none of these provides a straightforward way of arriving at a tax answer.

By contrast, generative AI solutions rely on conversational prompting, allowing tax practitioners to phrase their questions as if speaking to a colleague. Generative AI’s ease of use is apparent even during the initial stages of adoption. After logging into Blue J for the first time, users take an average of just 2.8 minutes to generate a comprehensive tax answer.

2.8 minutes to generate a comprehensive tax answer in Blue J after logging in for the very first time

(Source: Blue J User Data)

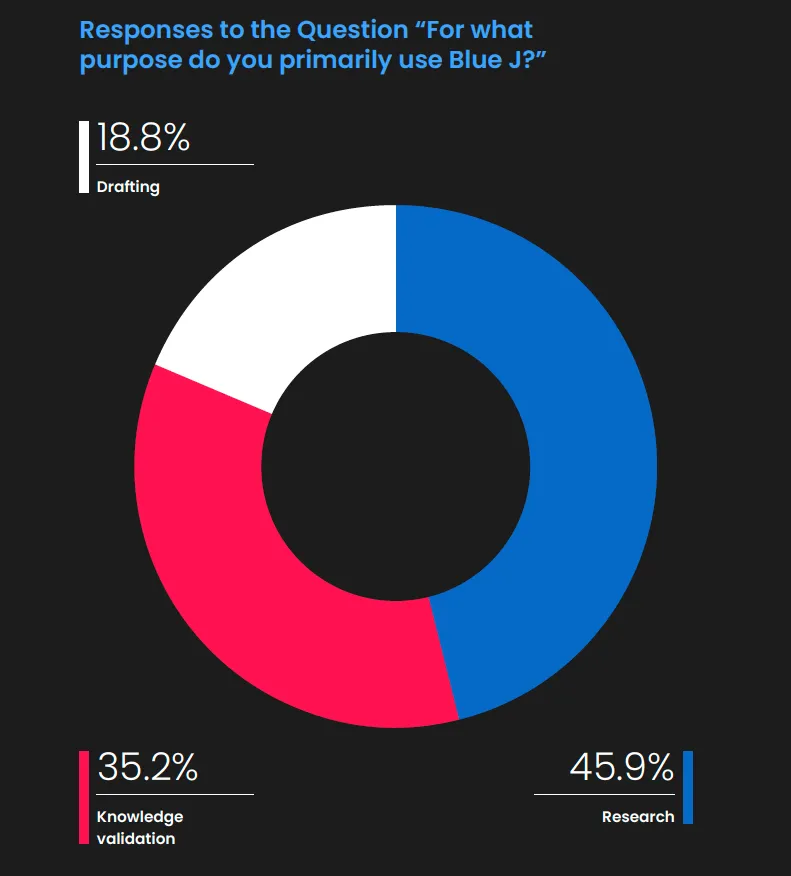

This ease of use doesn’t come at the cost of quality, as the responses these AI systems generate are also more cohesive than those offered by legacy solutions, weaving together multiple sources into a single, comprehensive response. For tax practitioners researching unfamiliar areas, these comprehensive responses can be invaluable for quickly gaining an overall understanding of a topic. For those working in more familiar areas, these answers can serve to validate their knowledge, ensuring it’s up-to-date and accurate.

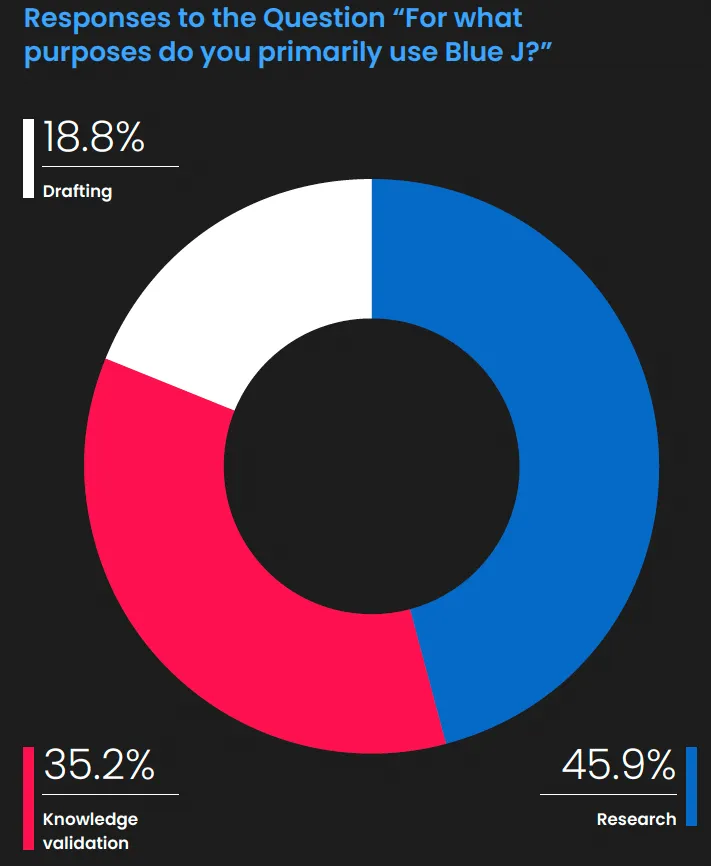

Outside of answering questions on a broad array of tax topics, generative AI-based tax research solutions can also turn those tax answers into client-ready communications. For Blue J users, drafting represents a notable portion of their usage, with 18.8% of respondents to a Blue J user survey listing drafting as their primary use case for the application. Because it’s often highly time-consuming to translate complex tax concepts for clients, automating even just a portion of drafting work can represent meaningful time savings.

Between accelerated research and automated drafting, tax practitioners leveraging AI-powered tax research solutions are realizing significant efficiency gains. Among Blue J users, 93% agree that Blue J saves them time, at an average of 2.94 hours saved per user per week.

93% of tax practitioners surveyed say Blue J saves them time

(Source: Blue J User Survey)

2.94 hours/week saved, according to tax practitioners surveyed

(Source: Blue J User Survey)

For all the benefits of saving time with AI-powered tax research, this newfound efficiency can also produce some anxiety. Accountants and other tax professionals have traditionally charged for their work on an hourly basis, although some are moving to a subscription model. Firms still operating under the traditional approach may have concerns that reducing the time spent on a particular task will also reduce the amount that can be billed for that task.

However, firms leveraging AI-powered tax research are learning to repurpose their time savings to deliver deeper client value. Blue J customer Larson Gross Advisors has been able to redirect time that previously went towards research and drafting into conducting complex research tasks, helping clients think through key decisions, weigh their options in different scenarios and tax treatments, and understand the broader impact of their choices. At the same time, they’re also shifting how they charge clients, adopting a value-based billing model that reflects the increased efficiency and value of their work.

The AI Tipping Point

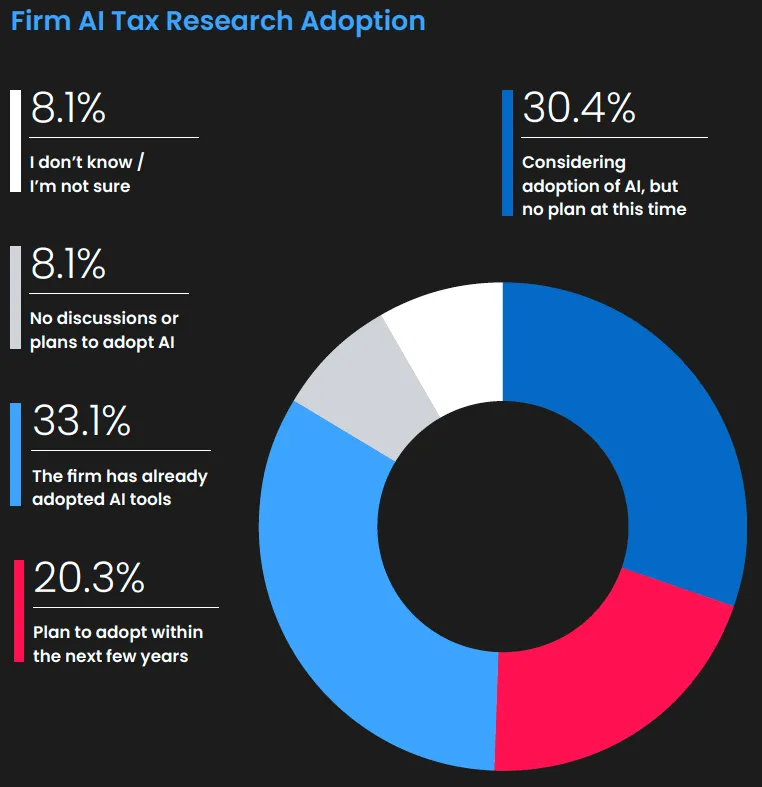

Although AI-powered tax research is gaining adoption momentum, many firms have yet to integrate these tools into their tech stack. Interestingly, our survey results revealed a discrepancy between the number of respondents who report using AI in their tax research (54.4%) and the percentage who work for firms that have formally adopted AI-supported tools (33.1%).

This gap suggests some practitioners are using AI for tax research at firms where there is no official AI tax research solution in place. Like search engine usage, this rogue AI usage could pose a problem for firms if it means practitioners are leveraging general-purpose AI tools. While general-purpose AI tools are easy to incorporate into research workflows, the efficiency they offer often comes at the expense of answer quality. Since these tools pull from a wide range of uncurated sources, they’re prone to error, often basing answers on irrelevant and outdated sources that are difficult to verify.

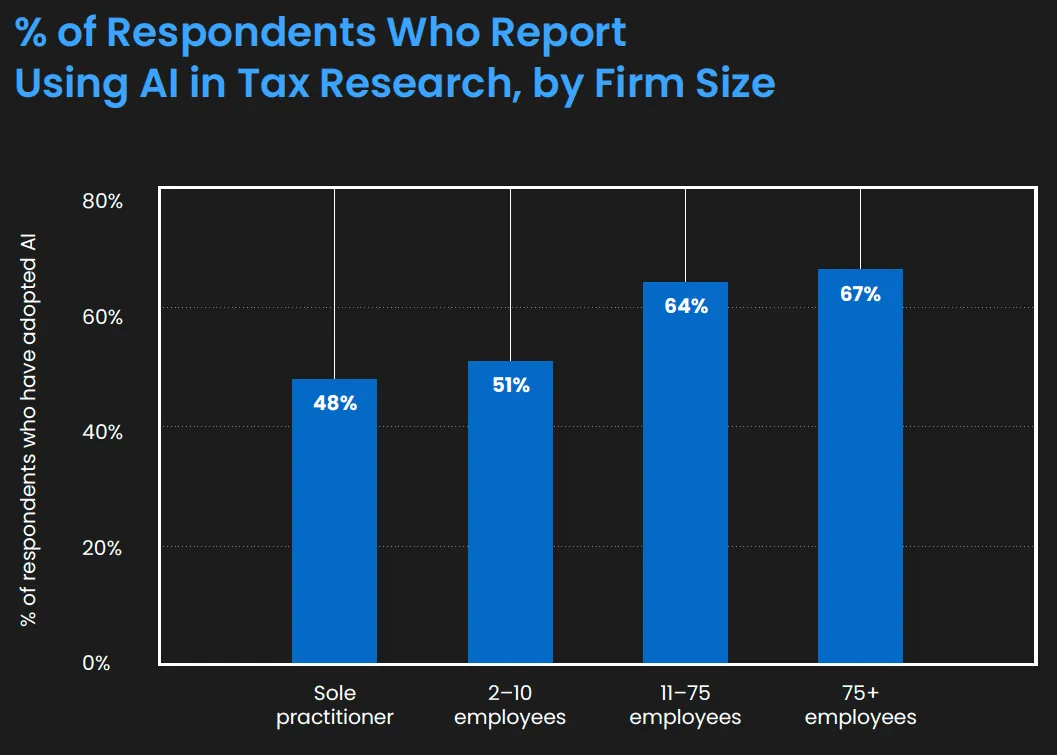

Another interesting AI adoption gap we observed was across firm size. Respondents at larger firms were more likely to report using AI for their tax research compared to those at small firms. With 67% of those at firms with 75+ employees reporting AI usage for tax research, compared to just 48% of sole practitioners, larger firms appear far more AI-forward. It’s possible this difference could be due to larger firms being more likely to have AI mandates and digital transformation strategies in place.

Firms of all sizes stand to benefit from AI-powered tax research, but smaller teams feel some benefits more keenly. Unlike their large-firm counterparts, tax practitioners at small firms typically lack access to a team of colleagues they can consult on unfamiliar tax matters. Given that AI solutions can essentially act as an additional team member—capable of assisting with both research and drafting work—these smaller firms are missing an opportunity to supplement their teams and punch above their weight with AI. As Dan Snyder, Director of Personal Financial Planning at AICPA, puts it, “Small firms perhaps have the most to gain. AI integrations enable them to amplify their inherent agility and innovation to bridge gaps in a competitive landscape.”

Growing Performance Gap

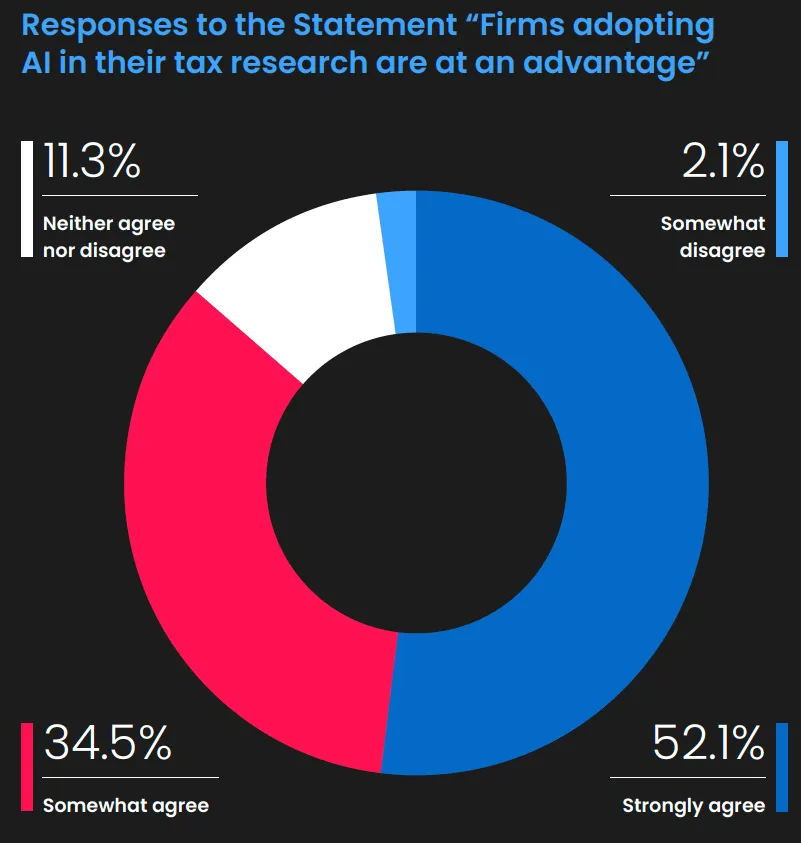

Whatever their size, firms that fall behind in AI adoption are also falling behind in performance. For most of the tax practitioners we surveyed, this isn’t news. Even though 54.4% of respondents reported using AI for their tax research, 86.6% agreed that firms adopting AI in their tax research are at an advantage.

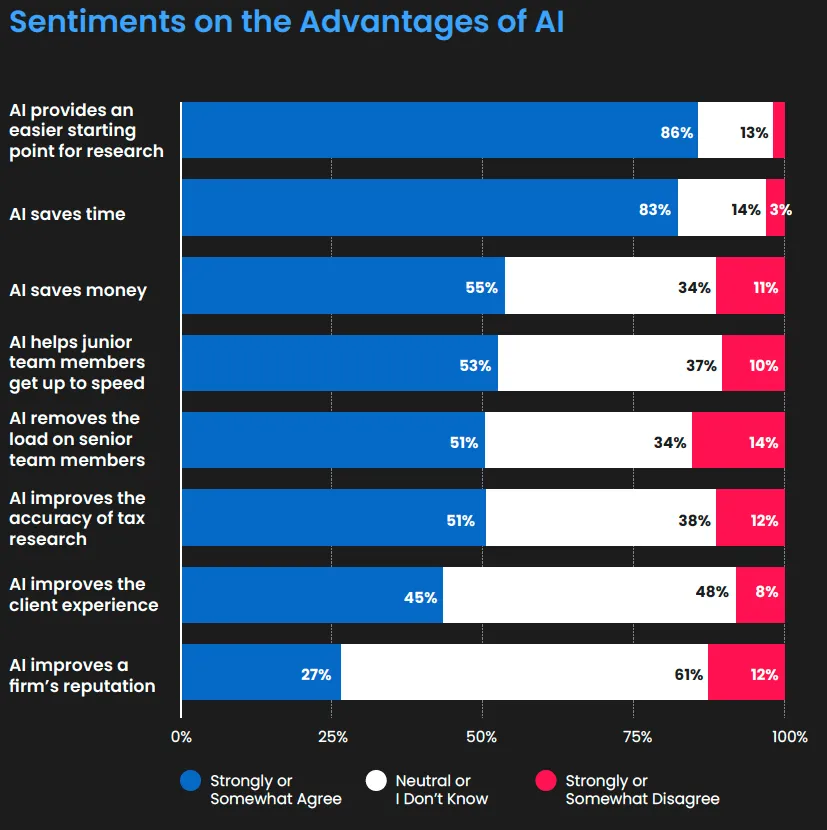

When asked about the specific advantages AI offers firms, respondents cite ease of research (86%), time savings (83%), and money savings (55%) as the top three benefits.

When comparing this chart to the top three complaints respondents have about legacy tax research solutions—that they’re time-consuming, expensive, and difficult to navigate—the perceived benefits of AI-powered solutions appear to align almost exactly. Beyond perceptions, AI solutions are actually delivering on these benefits, as seen in Blue J user data.

Beyond Early Adopters

Even firms that are enthusiastic about the potential benefits of AI-powered tax research may still doubt whether AI’s current capabilities can live up to their expectations. This attitude is understandable given the technology’s relative novelty compared to legacy tax research tools, but we’re no longer in the early adopter phase. Not only have thousands of leading firms already adopted AI for tax research, but these firms have also measurably advanced the performance of these solutions.

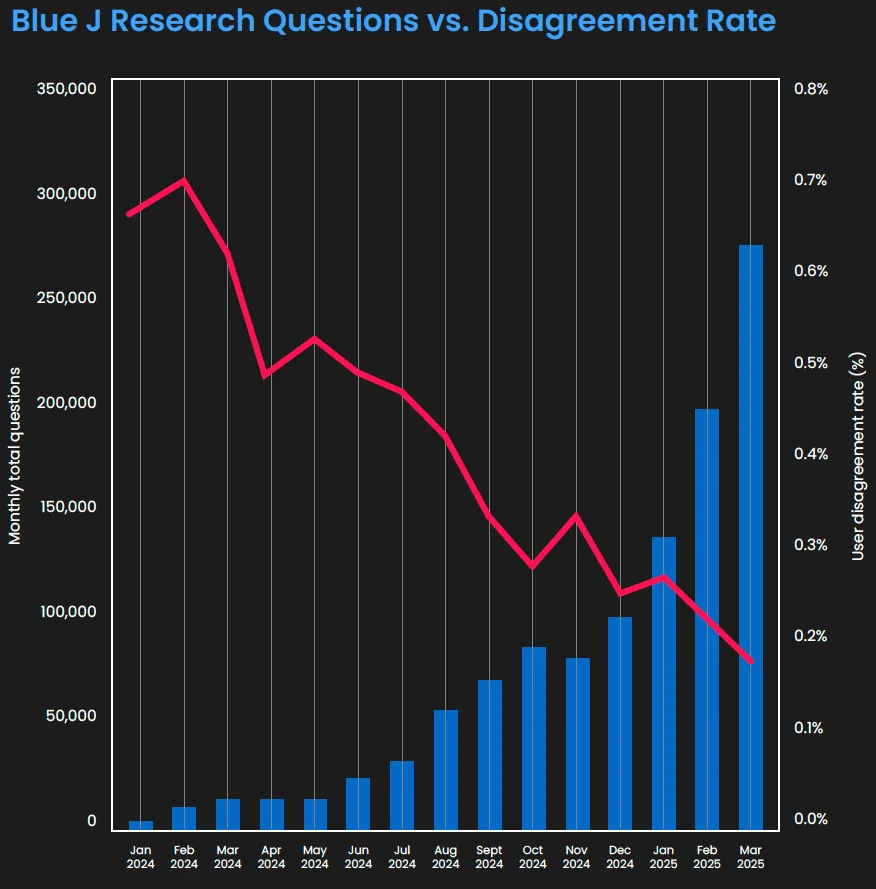

In Blue J’s case, a tight user feedback loop means that increased usage leads to improved performance, contributing to a sharp decline in the rate at which users disagree with the solution’s tax answers (now <0.2%). As accuracy continues to improve with usage, the hesitancy some firms feel about AI becomes harder to justify.

Demographics Shift

There’s a distinctly human factor incentivizing firms to adopt AI. An unignorable demographic shift is currently underway in the tax and accounting professions. A shortage of junior talent and an aging workforce mean that firms are not only short-staffed today, but are also likely to struggle with filling seats in the future. For all firm sizes except sole practitioners, finding qualified staff ranked as the top issue in the 2024 Private Companies Practice Section (PCPS) CPA Firm Top Issues Survey.

In firms that have previously relied on junior staff to perform research, AI-powered tax research can provide a much-needed pair of extra hands, essentially acting as a junior associate. These tools can also go beyond the immediate fix of filling in for missing juniors, serving to attract new practitioners to the profession by shifting the type of work they’ll do. Rather than spending hours gathering sources and performing manual research, juniors with access to AI-powered tools can instead focus on asking analytical and strategic questions of the research, essentially fast-tracking them into the work they would be doing later in their careers. Additionally, many newer tax practitioners are already accustomed to using generative AI in school, so incorporating AI into the firm’s tech stack can serve as a powerful recruitment and retention tool.

As Blue J customer Bartlett, Pringle, and Wolf, LLP has found, leading with AI can give them an advantage over other firms during recruitment season. Jacob Sheffield, Tax Partner and head of IT, described the firm’s edge for winning over talent, saying, “It’s important that people have the best tools to do their job efficiently and perform at a high level. Having the latest and greatest from Blue J sets us apart from other firms they might be considering.”

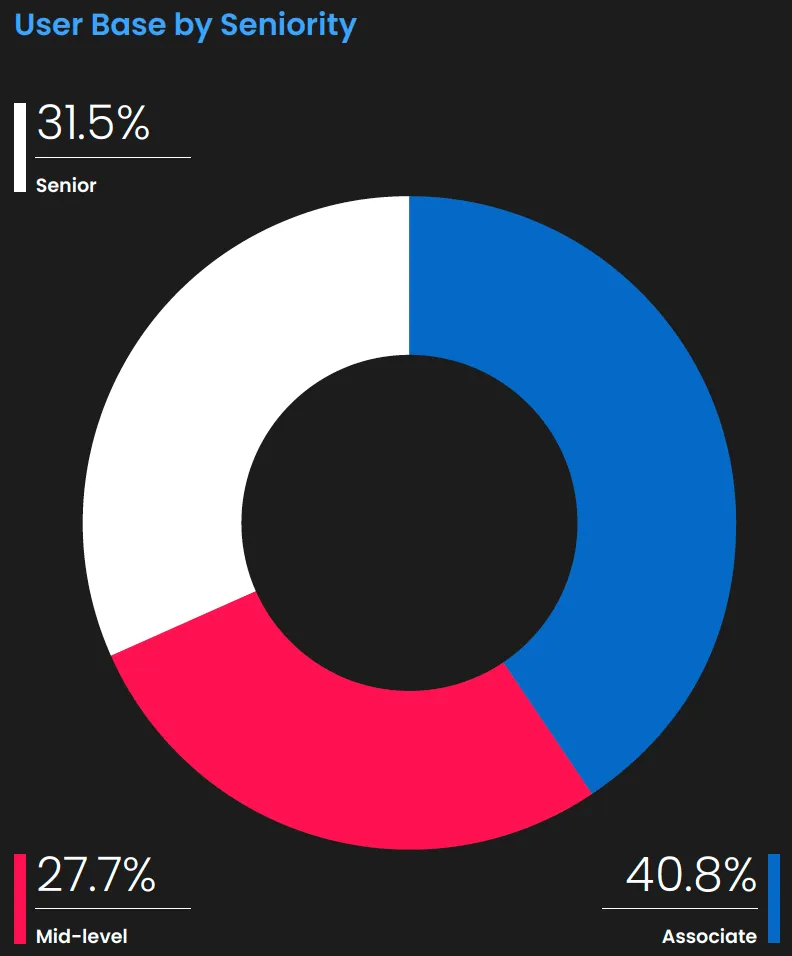

Although junior staff may be most familiar with and enthusiastic about generative AI, AI-powered tax research isn’t just for juniors. Blue J’s user base is relatively evenly distributed across associates (40.8%), mid-level practitioners (27.7%), and seniors (31.5%).

Overcoming Barriers to Adopting AI Tax Research Solutions

Even now, firms considering AI-powered tax research are likely to face several—real or perceived—barriers to adoption. To help counteract these fears, we’ve gathered perspectives from several tax and accounting professionals.

Fears of Replacement

Currently, generative AI can automate research, conduct next-step analysis, and draft research memos and client emails—freeing up time for higher-value advisory work. However, generative AI can’t exercise human judgment, make ethical decisions, or foster client relationships. As such, tax practitioners should view AI as a way to augment their capabilities, rather than replace them. Focusing on uniquely human skills and delegating to AI only where appropriate will allow firms to balance the efficiency gains of AI without detracting from overall firm performance.

“While there’s a lot of discussion around GenAI replacing tax accountants, GenAI in tax research is actually a huge win. Tax law is complicated and takes time to understand, so for our less experienced professionals, it helps them get up to speed faster. For our more experienced professionals, especially on esoteric tax research, the amount of time wasted trying to track down relevant court cases and rulings is cut considerably. We can skip right to the analysis and documentation. But if clients think they can use GenAI to replace us, either their tax compliance wasn’t that complicated, or they misunderstand the value that we bring. Either way, it frees us up to work with clients that value our services.”

Ashley Francis, CPA, Owner, The Francis Group, PLLC

Security Concerns

Not all generative AI applications have the necessary security measures to adequately protect client data, with some using information submitted by users to train their models. When selecting an AI tax research solution, look for applications that adhere to enterprise-grade best practices, feature a secure and encrypted database, are SOC 2 compliant, and are certified by an independent auditor.

“AI can be a powerful ally in a tax practice, especially for tax research, but without ethical oversight and strong data governance policies, it can certainly become a liability. As tax professionals, we can lead the way in using AI tools to identify efficiencies while also maintaining and upholding the trustworthiness that is so important for our profession.”

April Walker, CPA, CGMA, Senior Manager, Tax Practice & Ethics - Public Accounting, AICPA

Research Quality

Concerns about biased responses and hallucinations are common, particularly in light of recent, high-profile instances of these errors. However, response quality and accuracy continue to improve through retrieval-augmented generation, content curation, algorithm improvements, human-in-the-loop approaches, and user verification of output.

"We had used a traditional tax research tool for a long time but found it wasn’t particularly well-used in our practice. A lot of our practitioners would have to turn to Google to find what they were looking for, which of course isn’t ideal. Blue J is a real game-changer when it comes to this, since it combines the efficiency of Google with the authoritative tax materials our people really need to serve their clients best."

Matt Mueller, CPA and Partner, ELO CPAs

Cost

While it’s true that tax-specific AI research solutions are more expensive than their general-purpose AI counterparts, these solutions are still significantly less costly than legacy solutions, which have significantly lower adoption rates. As you consider the cost of AI-powered tax research, also consider the value of fast, accurate answers, as well as the cost of not adopting, which can result in less efficient research and fewer opportunities for higher-value strategic advisory work.

“Blue J is absolutely one of the best investments I've ever made into my business. I am a one-person company, and feel the biggest thing I'm lacking is a team to bounce things off of. Research takes a lot of time, and I'm obsessive about making sure things are done right. Now I feel like I have the "team" backup I have been missing, and cannot believe the excellent quality of the research responses Blue J has been giving me - what a huge load off of my shoulders!”

Leslie Hatridge, Enrolled Agent and Owner, Hatridge Tax and Accounting

Retraining Time

Generative AI is designed to be intuitive, relying on conversational prompts rather than Boolean searches. This intuitive approach means your team already knows how to use it, even before opening the application. After logging into Blue J for the first time, it takes users an average of just 2.8 minutes to generate a comprehensive tax answer.

“Before Blue J, we struggled with a cumbersome search engine that often left us turning to Google for additional research, leaving us uncertain about the accuracy of our findings. Frustrated and inefficient, we knew we needed a change. Blue J provided that change and more. Its intuitive interface and precision have made tax research not just easier but exciting - energizing our team to dive deeper and find the right answers for our clients faster than ever before.”

Samantha Bowling, CPA CFE CGMA, Managing Partner, GWCPAs

Resistance to Change

Tax research has been done a certain way for a long time, relying on a set of tools that many members of your team may be comfortable using. Change won’t happen unless they get a chance to experience all of the benefits generative AI has to offer firsthand. Some firms consider a trial period or phased rollout to allow team members across all levels to see just how naturally new technology can fit into their day-to-day workflows.

"We’ve found that Blue J’s value to our process is clear, regardless of a practitioners’ experience level. For the more experienced practitioners, they are using Blue J to quickly validate their instincts and draft initial work that they’re in a great position to edit. For more junior practitioners, it provides a great place to start their work so they can get more experience in research tasks. Having a cutting-edge tool that enables everyone to do their work more efficiently and effectively helps our firm deliver better results for clients, faster.”

Ellen Juram, Director, Barnes Dennig

As overwhelming as these barriers may seem at first, they can be overcome. Given the growing performance gap between AI tax research adopters and non-adopters, firms must either find a way to overcome these barriers or risk being left behind.

What’s Next?

The findings of the Blue J and CPA.com AI Tax Research Solution Outlook Report make one thing clear: AI is no longer just an experiment for tax practitioners. Already, AI-powered tax research is creating measurable improvements for adoption rates and research speed, providing a tangible advantage over legacy tax research solutions.

For firms still evaluating whether to take the leap, the decision window is narrowing. Those who delay will find themselves in a widening gap, competing against peers who are faster, more informed, and more efficient. And while barriers to adoption remain, the many firms already thriving alongside AI are proof that these challenges are surmountable.

The future of tax research is here. Now, it’s up to tax practitioners to decide when they’ll join that future.