This article looks at what "Double Dummy" structures are and provides diagram examples that you can reference. You will find a standard Incorporation Structure example and then a "Double Dummy" Structure example. We reference IRC § 368(c), IRC § 351 and other relevant Code provisions, discuss special considerations for SPACs, and provide other tips when proceeding with a merger of this kind.

A “double dummy” structure chart is a merger method often used to facilitate a “merger of equals.” It can also help to accelerate the timeline of a proposed merger where a more standard approach would require a shareholder approval process or where the percentage of cash consideration contemplated is greater than would be permitted with a typical merger. When performed properly, the double dummy structure will qualify as a transfer pursuant to IRC § 351.

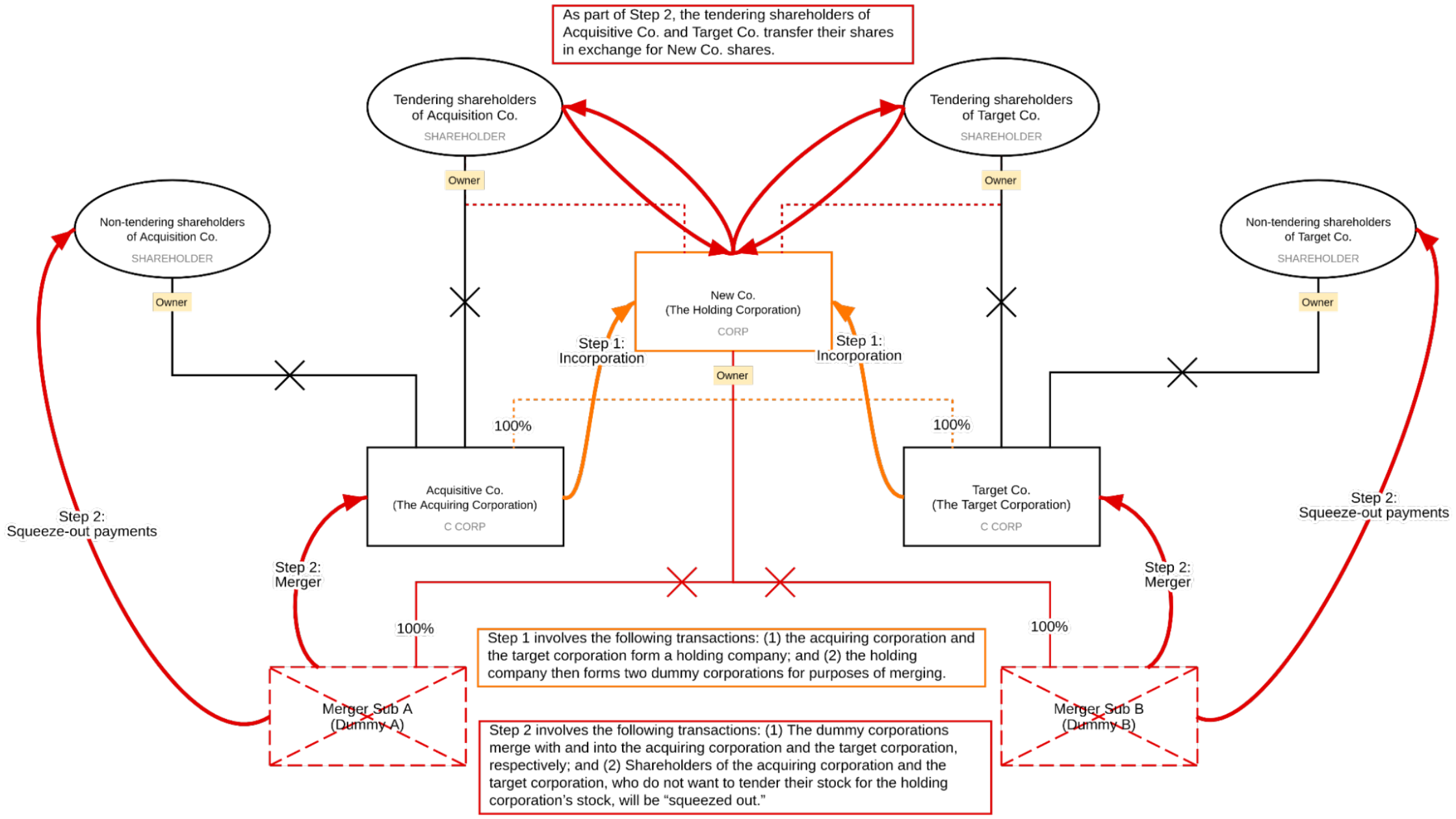

A double dummy structure chart involves the following steps:

A typical incorporation transaction will be structured like the following:

This diagram depicts an incorporation transaction governed under IRC § 351. Under IRC § 351(a), no gain or loss is recognized when one or more persons transfer property to a corporation solely in exchange for stock of that corporation, and the transferor(s) “control” (defined under IRC § 368(c)) the corporation immediately after the exchange.

The following diagram illustrates what is commonly referred to as a double dummy transaction.

This structure chart depicts what is commonly known as a “double dummy” transaction. This transaction involves the combination of two or more operating corporations, which are often equal in size, under a new corporation, usually with the view towards a public offering of the stock of the new corporation.

The transaction as depicted in this structure chart involves the formation of a new holding company as the primary vehicle to facilitate the combination. The dummy corporations are created by the holding company as the merging subsidiaries, each of which merges into one of the operating corporations seeking the combination. The tendering shareholders of each operating corporation receive shares in the newly organized holding company. This transaction may qualify as a tax-free corporate reorganization under IRC § 368(a)(2)(E). However, provided the shareholders of the combining corporations together receive at least 80 percent of the stock of the holding company (thereby satisfying the IRC § 368(c) “control” requirement), the transaction can qualify as a tax-free incorporation transaction governed under IRC § 351. See Rev. Rul. 84-71, 1984-1 C.B. 106.

This structure uses action arrows to signify the transfer of stock or assets and our labeling feature allows you to customize entities, relationships, and actions. The color scheme and text boxes also provide a convenient way to describe the actions and visually link the consequences of each action to newly-formed relationships between entities.

Blue J Diagramming’s various features are specifically tailored to the needs of tax practitioners. With it, practitioners can use shapes and conventions they are already familiar with to easily visualize relationships between entities and even propose or dissolve relationships and entities in a multi-step transaction.

In structuring a “double dummy” transaction, practitioners must pay close attention to the tax consequences. As a general rule, a “double dummy” transaction should qualify as a tax-free transfer of property to a controlled corporation under IRC § 351. Even though a “double dummy” transaction involves the use of mergers, no continuity of business enterprise or limitation on the amount of boot paid to the non-tendering shareholders is required. Contra. IRC § 368 ; Treas. Reg. § 1.368-1(e)(2)(i)-(iii). Practitioners must also be cautioned that the use of a “double dummy” transaction with respect to a special purpose acquisition company, or “SPAC,” does not provide tax-free treatment on the exchange of SPAC warrants.

Blue J’s diagramming tool provides a convenient way to visually represent the acquisition technique known as the “horizontal double dummy technique”, primarily used for a merger of two or more “equals.” More example diagrams like these can be found in our Blue J Folios, resource bundles that provide a starting point for your research. Users will find an outline that summarizes the topic, links to the relevant Code and Treasury Regulations, common leading authorities on each topic, and diagrams of these authorities created with our Diagramming tool.

Interested in double dummy structures and more diagram examples? Check out these Revenue Rulings we have diagrammed, available for free, that involve 351:

Rev. Rul. 2003-51 - Successive § 351 exchanges and control requirement

Rev. Rul. 2015-9 - Section 351 transfer with D reorg and step transaction

Rev. Rul. 2015-10: Triple drop and check (351 exchanges with D reorg

Rev. Rul. 2007-8, Sit. 1: Overlapping § 368(a)(1)(D)/354 with § 351

Rev. Rul. 2007-8, Sit. 2: Overlapping § 368(a)(1)(C) with § 351

Rev. Rul. 95-74: Contingent environmental liabilities and § 351

Rev. Rul. 84-71: COI not required in a § 351 despite reorg overlap

Rev. Rul. 80-323: § 357(c) applies to § 351 transfer of a partnership interest

Rev. Rul. 84-111, Situation 1: § 351 exchange preceding partnership termination

Rev. Rul. 84-111, Situation 2: § 351 exchange follows partnership termination

Rev. Rul. 84-111, Situation 3: § 351 exchange terminates partnership

Rev. Rul. 84-44 Rev. Rul. 84-44: No § 368(c) control in multi-step transaction

Rev. Rul. 83-34: Successive section 351 transfers

Rev. Rul. 83-156: § 351 transfer followed by § 721 contribution

Rev. Rul. 85-164: Basis and holding period in § 351 transfer

Rev. Rul. 80-228: Anti-Wham

Rev. Rul. 77-449: Double-drop transfers governed by § 351

Rev. Rul. 70-140: Transitory stock ownership fails § 368(c) control

Rev. Rul. 79-70: § 368(c) control is broken by a planned sale of stock

Rev. Rul. 79-194, Sit. 1: Owner shifts among § 351 transferors

Rev. Rul. 79-194, Sit. 2: Stock sold to 1% transferor; fails § 368(c)

Rev. Rul. 76-123: "C" reorg in context of § 351

Found this article helpful? Then check out these guides on reorganizations and mergers:

To access this diagram, and hundreds of others like it for a range of tax topics, get a Blue J Diagramming Demo today.

Sign up for the Blue J newsletter today.

Whether you have questions or are interested in booking a demo, we would love to hear from you.